With the Federal Reserve increasing rates last December, and

predicting two more rate increases in the near future, how are these changes

going to affect your purchasing power? What

is purchasing power you ask? Simply put,

it is the dollar amount of home you can afford in your given budget. Some buyers get confused and think the interest

rate only affects your monthly payment, but your interest rate also has a

drastic influence on the overall purchase price you can afford as well. Let’s exclude property taxes and homeowners

insurance for a minute since those vary from house to house, city to city, and

solely look and principal and interest.

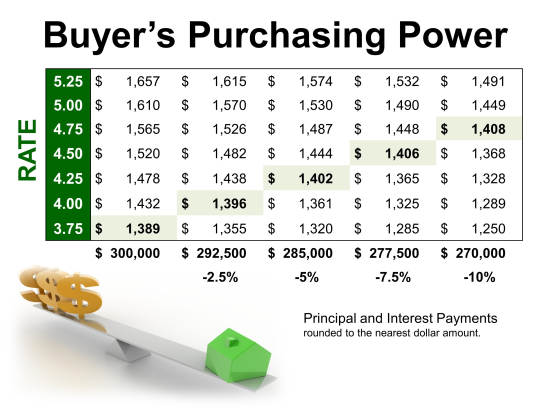

The below chart highlights principal and interest payments

around $1400. Well, if you bought your

home in the middle of 2016, you would have been able to purchase a $300,000

home. Today’s interest rate on a 30 year

fixed is just above 4%. Remember, the

FED is predicting two more rate increases in the near future, so the rate could

quickly move to 4.5% before you know it. If those predictions hold, you will only be able to afford a $277,500

home. Your income hasn’t changed in this

equation. Only timing and interest

rates. Keep this in mind if you are on

the fence on whether or not now is a good time to purchase.